The Federal Reserve raises interest rates as inflation becomes the top economic story, bringing headwinds to Wall Street.

THE YEAR IN BRIEF

2022 was a year of challenges for investors. High inflation challenged consumers and the Federal Reserve, which took the benchmark interest rate to a level unseen in 15 years. As it cost more to buy and borrow, businesses struggled to maintain their profit margins, which shook confidence on Wall Street. Mortgage rates rose, which impeded home sales. The first war in Europe in 30 years and COVID-19 lockdowns in China affected supply chains and overseas economies. The U.S. economy added jobs all year, and gross domestic product (GDP) rebounded in the summer. As the year ended, Congress passed new legislation to help retirement savers, and seniors received their most significant Social Security benefits increase in decades.

THE U.S. ECONOMY

Inflation was an issue all year. The Consumer Price Index (CPI) rose from 7.5% in January to 9.1% in June, down to 7.1% in November. The Federal Reserve responded to this inflation pressure with seven interest rate hikes, taking the target range on the federal funds rate from 0.25%-0.50% in March to 4.25%-4.50% by December. The central bank also phased out its bond-purchase program, born when the economy needed a stimulus.1,2

Economic activity slowed in the first half of the year. Real GDP came in at -1.6% for Q1 and -0.6% for Q2. Activity improved in Q3 with 3.2% growth. Consumer spending was strong; the Bureau of Economic Analysis recorded monthly gains of 1.2% in January, March, and June. The consumer spending indicator rose 0.6% or more in eight of the first eleven months of the year.3,4

Did the U.S. flirt with a recession in 2022? Not according to the labor market. America’s workforce added an average of 392,000 net new jobs per month in the first eleven months of the year, and unemployment never exceeded 4% (the jobless rate, according to the Bureau of Labor Statistics, was at 3.7% in November).5,6

Even with higher borrowing costs, the services sector grew all year. The Institute for Supply Management’s non-manufacturing sector index stayed above 50 (indicating expansion) for each month of 2022. ISM’s companion manufacturing sector index posted its first sub-50 reading since May 2020 in November.7,8

The rising interest rate environment hurt the housing market. Mortgage rates more than doubled between New Year’s Day and Christmas. Home sales slipped for nine months beginning in February, and prices fell. The National Association of Realtors calculated the median existing-home price at $379,100 by October, down from June’s historic high of $413,800. The number of homes on the market grew.9

We enter 2023 with Social Security recipients getting an 8.7% raise, the largest inflation-adjusted boost to retirement benefits since 1981. Reforms passed in Congress now give tax-advantaged retirement account owners one more year to put off mandatory annual withdrawals (in most cases, they must now begin at 73) and allows larger catch-up contributions to these plans starting in 2024.10,11

THE GLOBAL ECONOMY

Russia’s invasion of Ukraine prompted the biggest global energy crisis since the 1970s, disrupting natural gas, oil, and coal supplies and contributing to price inflation for these commodities. Citing this development, the Organization for Economic Cooperation and Development (OECD) sees but 2.2% worldwide economic growth for 2023. In contrast, the OECD says the world economy expanded by 5.9% during 2021.12

China had a rough economic year. The country’s zero-COVID policy, which returned swiftly in the fall, put clamps on manufacturing output and consumer spending as the government restricted travel and commercial activity, resulting in 6-month lows for retail sales and factory production in November. Chinese real estate investment slipped 19.9% across 12 months ending in November, the worst year-over-year performance in this century.13

The MSCI EAFE index, which tracks developed-economy stock market performance in Asia and Europe, fell 16.86% in 2022. Among other consequential global indices, the best 2022 performers were Brazil’s Bovespa, up 4.69%, and India’s Nifty 50, up 4.33%; the worst was Russia’s RTS, down 39.18%.14,15

LOOKING BACK, LOOKING FORWARD

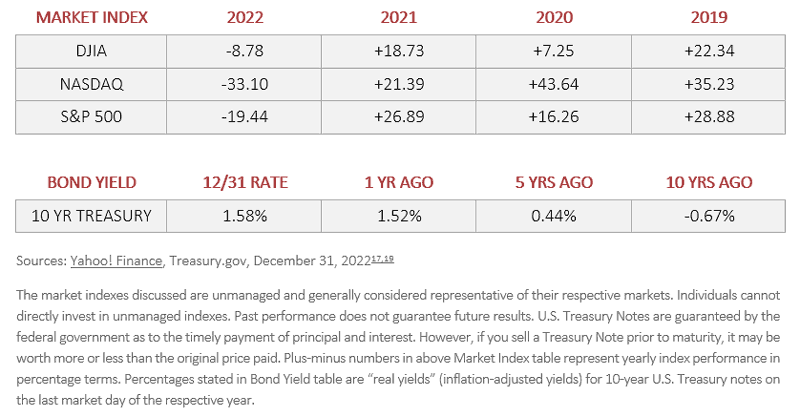

As Wall Street watched, interest rates rose, and bond and stock prices declined. The Nasdaq Composite did not have a winning quarter in 2022, but the S&P 500 and Dow Jones Industrial Average rallied in Q4, respectively, climbing 7.08% and 15.39%. The Nasdaq ended the year at 10,466.88, the S&P at 3,839.50, and the Dow at 33,147.25. The small-cap Russell 2000 benchmark also posted a Q4 gain, rising 5.80%; it was down 21.56% for the year, closing 2022 at 1,761.25.16,17

Wall Street is worried about a recession this year. Some market observers believe one will happen, as they are unconvinced that the Fed can engineer a soft landing for the economy. If inflation peaked, it could remain above the Fed’s longstanding 2% target for some time. The question is if central bank policymakers can accept inflation above that target and therefore elect to pause or conclude interest rate hikes. Inflation aside, the job market is hot by historical standards, and unemployment is under 5%; the economy grew again in Q3 by 3.2%, and early indications suggest Q4 was positive, too. Much rides on the Fed; Wall Street will be watching.

For more information or to book an appointment to discuss your financial year in review, please give us a call! You can reach Choice Financial Services, Inc. in Oklahoma City by calling 405-843-5540 or by emailing info@choicefinancial.com.

Sources:

Citations:

1. Bureau of Labor Statistics, January 1, 2023

2. Forbes Advisor, December 14, 2022

3. Trading Economics, January 1, 2023

3. Trading Economics, January 1, 2023

5. Bureau of Labor Statistics, December 2, 2022

6. CNN Business, January 1, 2023

7. Investing.com, January 1, 2023

8. Investing.com, January 1, 2023

9. Forbes Advisor, December 21, 2022

10. Yahoo! Finance, December 29, 2022

11. Yahoo! Finance, December 23, 2022

12. New York Times, November 22, 2022

13. Al Jazeera, December 15, 2022

14. CNBC, January 1, 2023

15. Barchart.com, January 1, 2023

16. CNBC, December 30, 2022

17. MarketWatch, January 1, 2023

18. Treasury.gov, December 30, 2022

19. Macrotrends, January 1, 2023