Social Security can be one of your most important benefits in retirement, but deciding when to take it can be tricky. Here is what you need to know!

One of the most common questions people ask about Social Security is when they should start taking benefits. Making the right decision for you can have a meaningful impact on your financial income in retirement.

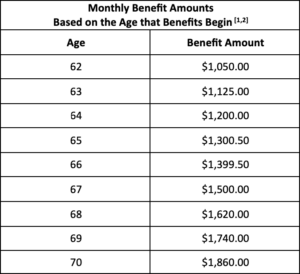

Before considering how personal circumstances and objectives may play into your decision, it may be helpful to preface that discussion with an illustration of how benefits may differ based upon the age at which you commence taking Social Security.

As the accompanying chart reflects, the amount you receive will be based upon the age at which you begin taking benefits.

*This example assumes a benefit amount of $1,500 at the full retirement age of 67 months for those born after 1960.

At first blush, the decision may seem a bit clear-cut: Simply calculate the lifetime value of the early benefit amount versus the lifetime value of the higher benefit, based on some assumed life expectancy.

The calculus is a bit more complicated than that, however, because of the more favorable tax treatment of Social Security income versus IRA withdrawals, spousal benefit coordination opportunities, the consideration of the surviving spouse, and Social Security’s lifetime income guarantee that exists under current law. [3]

Here are three ideas to think about when making your decision:

- Do You Need the Money?

Retiring before full retirement age may be a personal choice or one that is thrust upon you because of circumstances, such as declining health or job loss. If you need the income that Social Security is scheduled to provide, however reduced, then taking benefits early may be the only choice for you.

- Consider the Needs of Your Spouse

If your spouse expects to depend on your Social Security income, the survivor benefits he or she receives after your death may be reduced substantially if you begin taking benefits early. It’s important to remember that, based on current life expectancy tables, women are likely to live longer than men.

- Are You Healthy?

The primary risk in retirement is running out of money, and the odds of living a long life in retirement call for waiting until you reach full retirement age so that you receive a full benefit for as long as you live. However, if your current health is poor, then starting earlier may make sense for you.

There are several elements you should evaluate before you start claiming Social Security. By determining your priorities and other income opportunities, you may be able to better decide at what age benefits make the most sense.

To learn more about retirement topics like Social Security, please contact us.

Sources:

- https://www.ssa.gov/benefits/retirement/planner/1960.html

- https://www.ssa.gov/benefits/retirement/planner/delayret.html

- https://www.irs.gov/retirement-plans/retirement-plan-and-ira-required-minimum-distributions-faqs

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation.